2023: What Can We Expect from the Markets?

After the New Year’s greetings and, if possible, a bit of a break, it is customary to approach the New Year with rolled-up sleeves and some good intentions.

Looking at the markets, what can we expect from 2023?

The most honest and sincere answer is: “I don’t know, the markets will probably go up but they could also go down.”

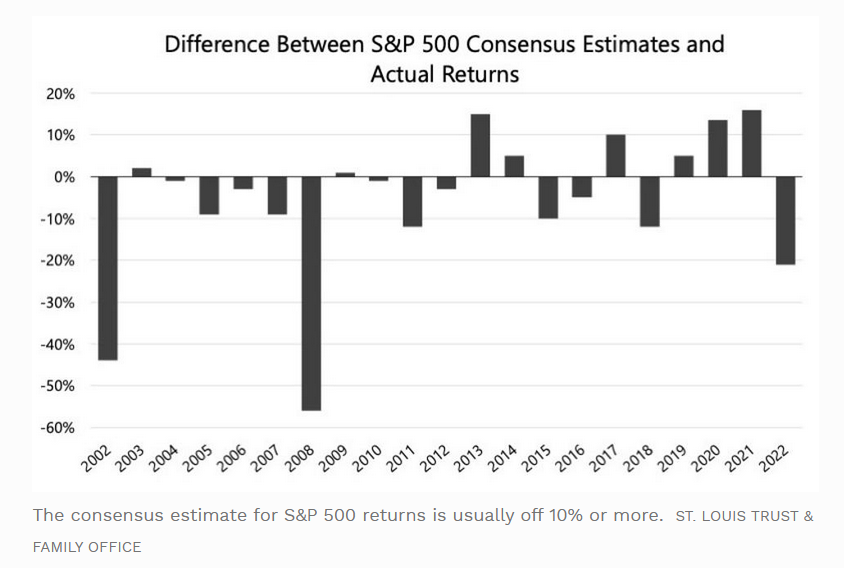

Although not very satisfying, this answer (published on 31/12/2022 in a Forbes article by John Jennings) is actually the one that has come closest to reality. This is because one-year market estimates are fundamentally flawed as in the short term there are many (perhaps too many), unforeseen and spurious variables that interfere with prices to the point that it is almost impossible to quantify the direction. An example, published in the same article, illustrates the annual deviations of analysts’ estimated returns from the actual returns of the American stock index S&P 500.

Source: Forbes.com

In some years (2002 and 2008) the difference between estimate and actual return exceeded 40% (so if, for example, the estimate was +10%, the actual return for the year was -30%). The forecasts seem to be particularly wrong when unexpected declines occur (like in 2022), while for the following years the deviations are more contained, as after a heavy decline it is normal to expect a market recovery.

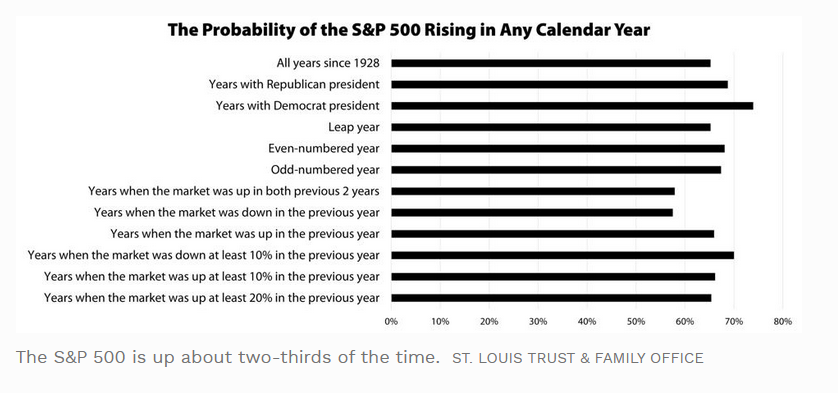

This reasoning becomes particularly evident if we consider that historically markets have offered positive returns two years out of three, as illustrated in the following chart (which indicates the probability of having a positive market return in a year based on different scenarios).

Source: Forbes.com

Reflecting a bit, the 2 out of 3 statistic is not a panacea but intuitive if we think that the reason for investing in the markets is that they are able, on average, to offer a positive return. Otherwise, there would be no incentive or motivation to invest.

This last consideration leads to one last but important aspect to keep in mind: the time horizon. As Jeff Sommers argues in an article in The New York Times published on December 16, 2022: forget the estimates for the next year and focus on those for the next decade. The author argues that the only way to invest without disappointment is to “embrace uncertainty,” meaning to accept that in the short term no one knows what will happen to their invested sum. Investors should first set aside (e.g., in a checking account or a very short-term government bond) enough liquidity to meet bills and short-term commitments and only then invest over longer horizons, otherwise, they end up speculating rather than investing.

The magic words for investing are always diversification and attention to costs. If you really don’t know what to do, the old and simple 60/40 portfolio rule (60% equities, 40% bonds) always seems to work, despite the ups and downs.

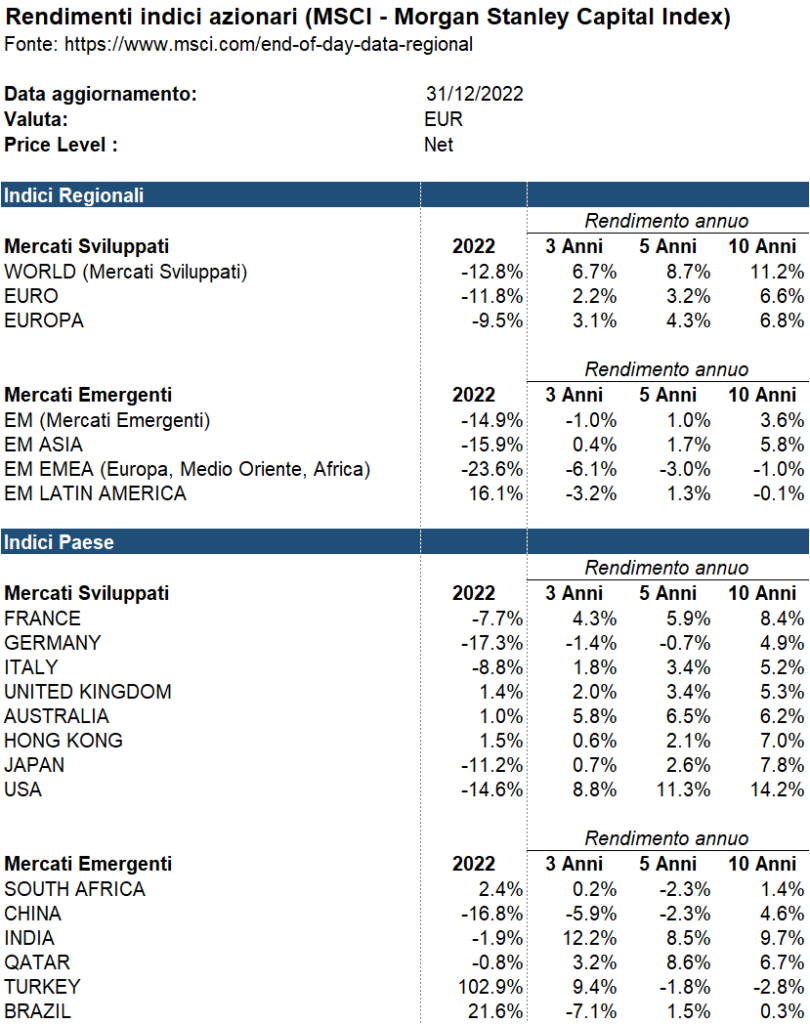

Appendix (Market Returns – Year 2022)

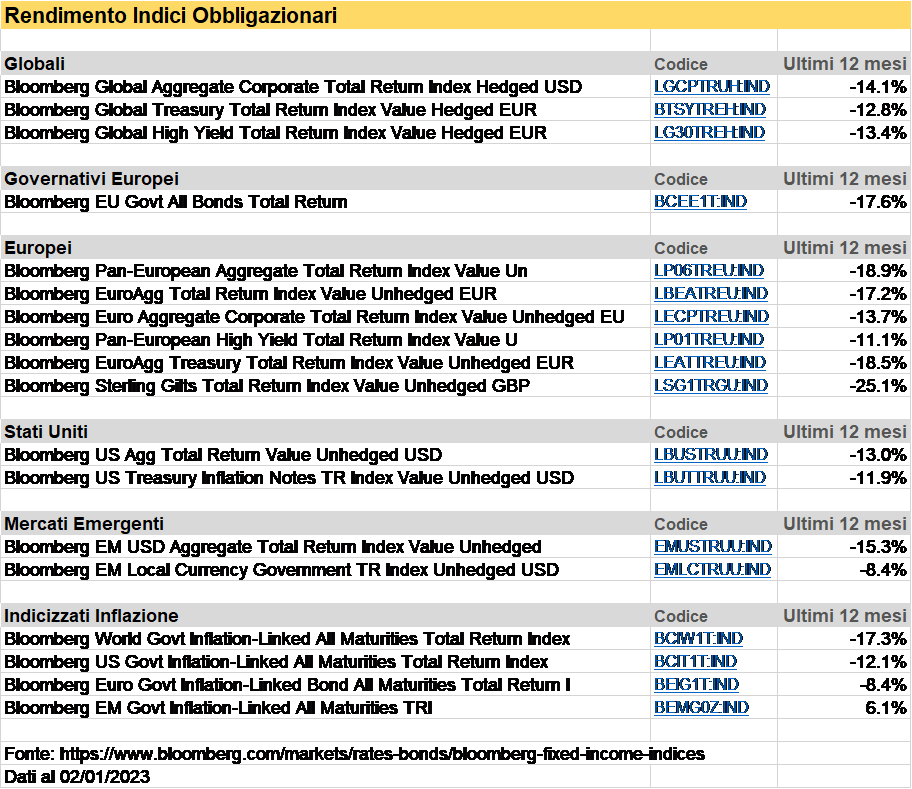

For reference, below are the performances of the main global equity and bond indices for the year 2022. As the data shows, 2022 was a year of “perfect storm” in the sense that a series of negative events occurred simultaneously for all asset classes (max inflation; sudden monetary policy restrictions; energy crisis following the Russian war in Ukraine).

Source: https://www.msci.com/end-of-day-data-regional

Source: https://www.bloomberg.com/markets/rates-bonds/bloomberg-fixed-income-indices Data updated as of 02/01/2023.