The year 2023 started with a significant rise in the markets, only to experience some setbacks due to the impact that the increase in interest rates by central banks is having on the economy, with particular attention to the banking sector.

As always, during times of uncertainty, the most exotic information spreads, and based on the questions received so far, it seems appropriate to clarify at least a couple of questions I often receive:

Question 1: “So, this year is a disaster in the markets too, right?”

Question 2: “How are Italian banks doing?”

1) So, this year is a disaster in the markets too, right? No: despite the turbulence of recent weeks due to uncertainty in the banking sector, the markets are still in positive territory this year. Let’s not forget that 2022 was a year of “perfect storm” where several factors occurred simultaneously, to name a few: inflation; uncertainty about the future of economies due to the war in Ukraine; sudden rate hikes by global central banks. This led to a general depreciation of almost all investment assets, especially in the bond sector (remember that bond prices move inversely to interest rates, see insight Do you (really) know how a bond works?).

The year 2023 is in a different market context: with interest rates back to more “normal” levels and stabilizing, bonds are now able to offer a positive appreciable yield and a decent degree of decorrelation from stocks, as seen during the period when Credit Suisse was declared bankrupt in March 2023: stock prices entered a period of high volatility while bond prices (especially for not too long maturities, e.g., 3 years) did not undergo significant changes.

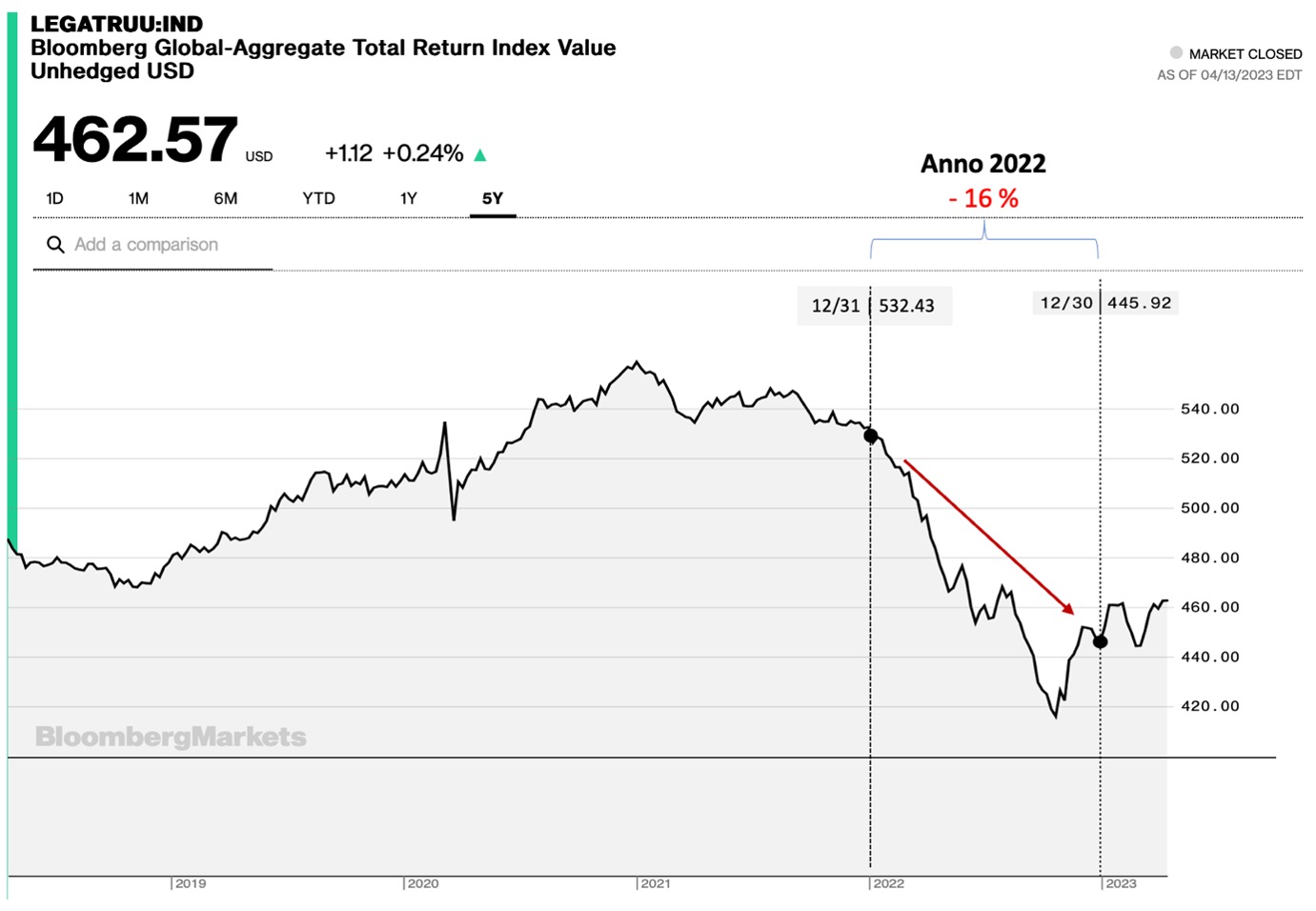

Below is the chart of the price of a global bond index published by Bloomberg (Bloomberg Global Aggregate Total Return), representative of the performance of bonds in general. As can be seen, the worst year was 2022 while this year bond yields are more stable (and slightly up, in view of the increased yields to maturity).

Global Bond Index Source: Bloomberg (https://www.bloomberg.com). Data as of 14/04/2023.

Bloomberg Bond Index Regarding stocks, the prices of listed equity markets vary based on expectations of the future performance of companies (in which we are invested, for those with equity exposure) so here too the most traumatic year was probably 2022 (see insight Expected Returns Today).

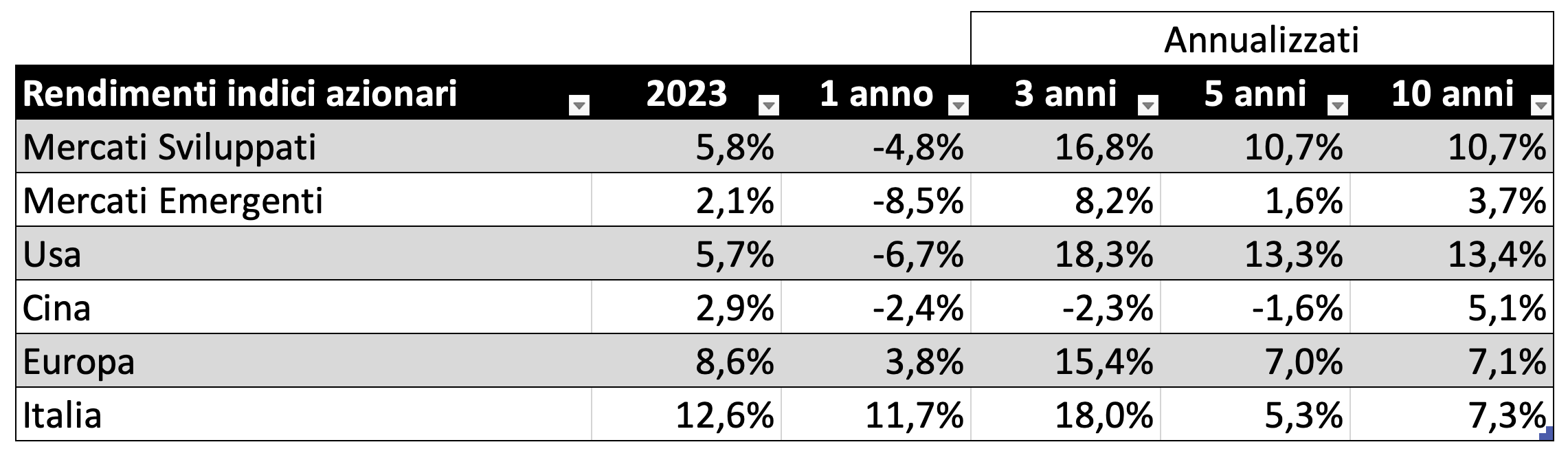

To contextualize with numbers, below are the returns of the main stock indices in recent years, up to the end of March 2023 (published by Morgan Stanley Capital Index).

Stock Index Returns MSCI Stock Index Returns

In the first three months of 2023, all indices increased in value (column 2023). Compared to a year ago, only Europe is positive as the indices had dropped more significantly with the outbreak of the war in Ukraine, a period prior to the year. Over longer horizons, the stock indices are positive, as can be expected from such an asset class.

2) How are Italian banks doing? While no one can systematically predict the future, in terms of banks, it is possible to make some general considerations that, at least in theory, should allow us to make more informed choices.

Referring to some insights (first of all, the one from 2017 – Are Italian banks really solid?), it can be said that generally the solidity of a bank can be measured by the quality of its loans, meaning that in addition to lending liquidity to reliable counterparts, it should do so profitably. Post the 2008 financial crisis, globally and especially in Europe, there has been a move towards stricter regulation of the banking sector, including stress tests and a link between the quality and quantity of loans a bank can make. In other words, banks can typically increase their business volume only if they lend to less risky subjects; over time, this has led the more solid institutions to marginalize the riskier clients as much as possible, who then found themselves “fleeing” to more “desperate” banks, perhaps small and seeking high (and typically speculative) profits.

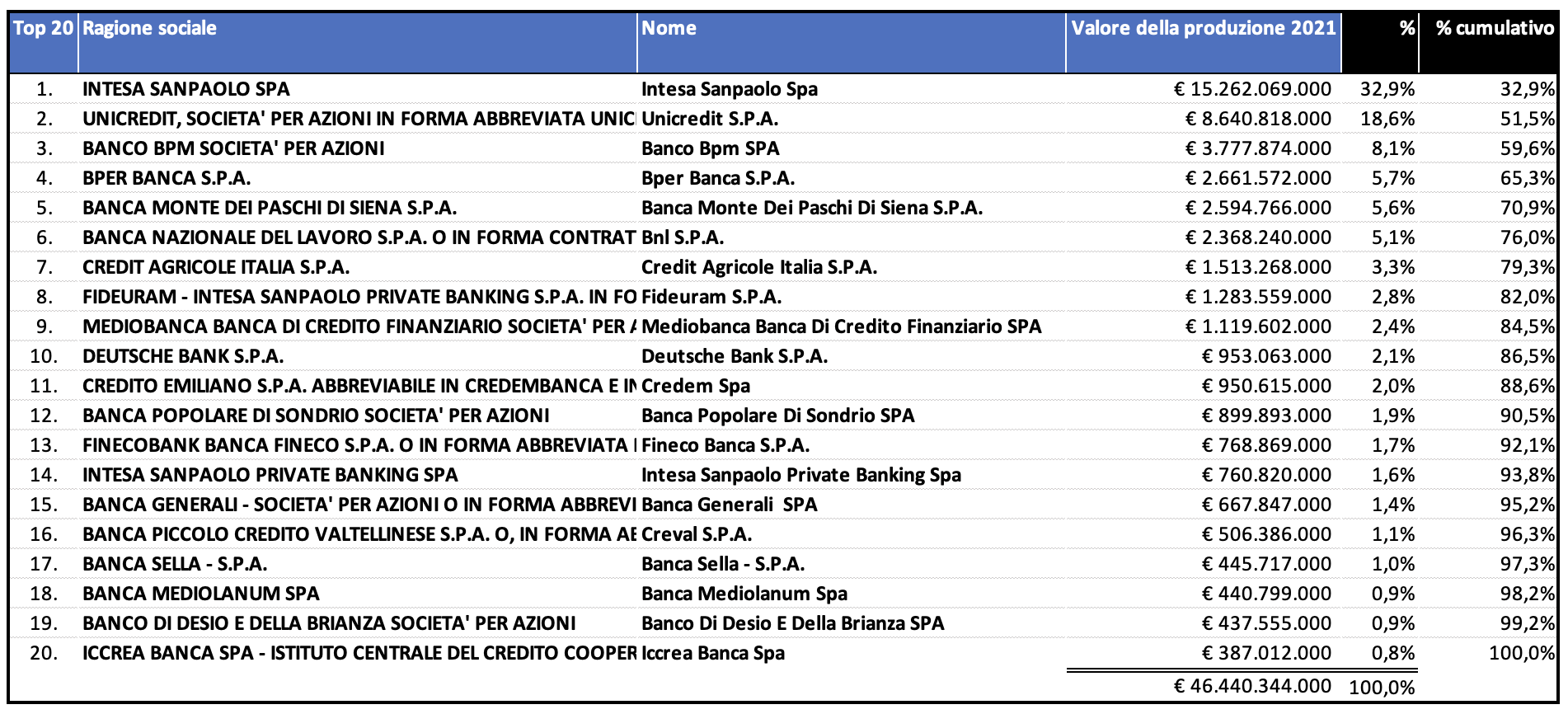

Following this logical thread, a preliminary investigation could be made based on the banks’ revenues, to measure their economic size. Below are the data of the top 20 Italian banks based on “revenue” (value of production).

Note: All data are updated as of December 2021, the common date for the publication of the latest available financial statements for all banks. More updated financial statements are available for some banks.

The Top 20 – Italian Banks by “Revenue”

Source: AIDA (Bureau Van Dijk), data processing by Alberto Miazzi, CFA.

It can be noted that there is a high concentration of activities in the top two banking institutions (Intesa and Unicredit) which alone represent more than half of the production value of the sample considered.

The size of the banks’ revenues decreases rapidly, with Iccrea Banca Spa (formed by the merger of small local banks) occupying 0.8% of the sample considered.

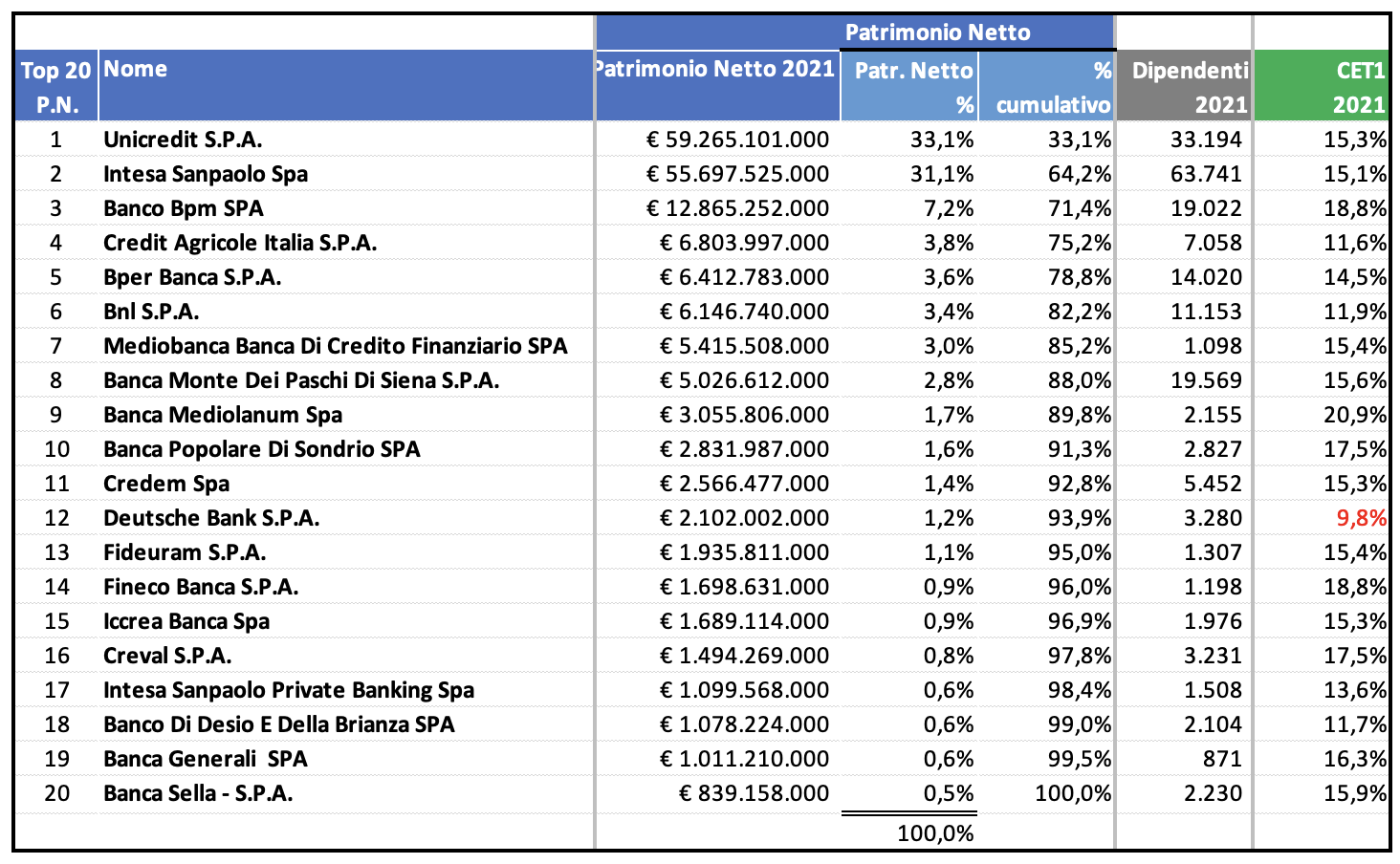

Of course, revenue is an indicator that alone cannot provide much information. Therefore, the table below reports a series of additional data on the banks mentioned above, this time ordered by ‘equity’ (i.e., the capital belonging to the shareholders that should be used to guarantee third parties ultimately).

The Top 20 by Equity (Employees and CET1)

Source: AIDA (Bureau Van Dijk), Company Financial Statements (for CET1). Data processing by Alberto Miazzi, CFA.

Here too, it can be noted that the top two banks (Intesa and Unicredit) are dominant in terms of equity size, accounting for 62% of the sample considered.

The CET1 column constitutes a primary quality indicator: regardless of any context that can be added, a CET1 exceeding 10.5% is a satisfactory measure of quality. On this basis, only Deutsche Bank SPA does not pass this test.

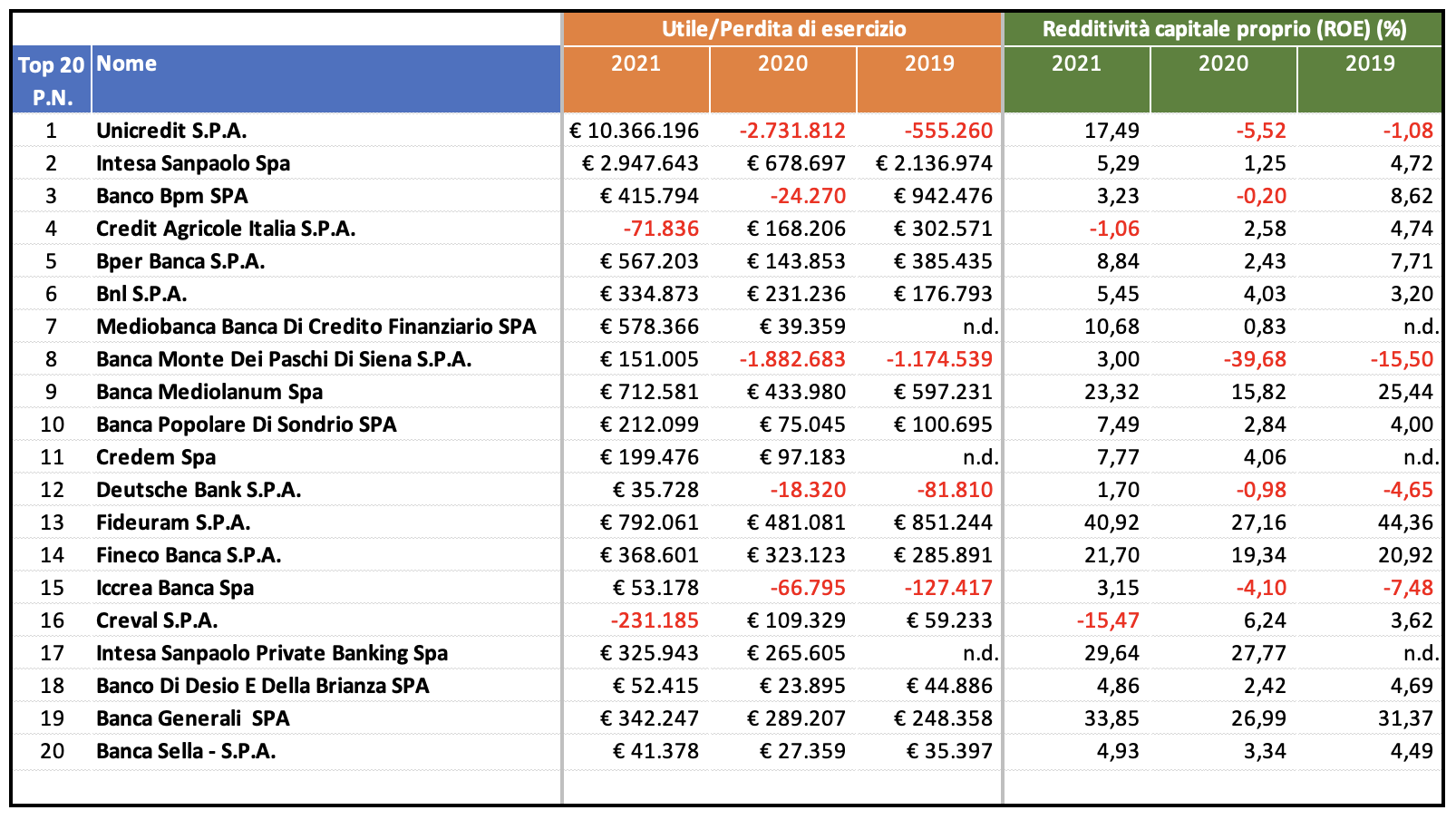

The following table attempts to add other reference indicators for the same banks, trying to provide a slightly more comprehensive view of their quality.

The Top 20 by Equity (Profit and ROE)

Source: AIDA (Bureau Van Dijk), data processing by Alberto Miazzi, CFA.

The orange columns measure whether the bank has closed its financial statements with a profit or loss over the last three years available. To standardize these data, the green columns then weigh the profit or loss against equity to provide a homogeneous profitability indicator (the ROE – Return On Equity), which allows for comparisons between banks of different sizes.

Simplifying a bit, ROE represents the return that a shareholder should expect from their investment in the bank’s equity. Since interest rates were very low during the 2019-2021 period, an ROE exceeding 5% over time could be considered satisfactory (this number coincides with the historical average risk premium for equity investments).

At a glance, it is evident that traditional banks struggle more to be profitable, in sharp contrast to network banks. This is natural when considering that traditional banks have significant exposure to loans that may be in distress and are now dealing with a significant but necessary reduction in personnel following the digitization of recent years that has made, for example, many branches superfluous (note the “number of employees” data in the table above).

The interest rate increase in 2022 should lead to increased profitability for “healthy” banks while it could create a crisis in less solid banks exposed to high-risk loans.

Conclusions In this insight, an attempt was made to raise awareness about the current situation of markets and the banking system in Italy as objectively as possible.

Stock market returns, besides having a reversion to the mean over time (more likely after a sharp decline in 2022), measure investor expectations on how the prices of listed companies will evolve. In the first months of 2023, these expectations have been positive. Obviously, it is unknown what will happen in the coming months, but it seems that some “bad” news has been digested compared to last year. Moreover, the sudden interest rate hike in 2022 has created increased expected returns for stocks and bonds, with the latter now able to provide a positive yield to maturity even in the short-term government sector (considered risk-free).

As for Italian banks, while it is not possible to precisely measure the solidity of each individual institution, some guidelines can be drawn to minimize unpleasant surprises. In particular, small and low-profitability banks are expected to struggle more during periods of crisis, in a regulatory system that tends to favor banks with high-quality loans and larger sizes.

Unlike stock market returns, financial statements measure what has happened in the past, so it is not certain that history will repeat itself in the future. That said, it seems preferable to have a measurable reference point to draw conclusions from rather than follow news leaks, which are not always placed in their proper context.